Increased consolidation and a large appetite for consumer companies amongst private equity firms in 2017

Strategic buyers are showing continued interest in and a clear rationale for buying Nordic consumer companies. At the same time private equity firms continue to invest heavily.

Acquired consumer companies during 2017

Strategic buyers have been active in the consumer market in 2017. Buyers have mainly shown interest in acquisitions that provide enhanced market positions and that contributes to an increases digital presence.

The market is consolidated through strategic acquisitions

Following the acquisition of Chilli in 2015 and Kodin1 in 2016, Bygghemma continues to strengthen their position by acquiring WeGot, Vitvaruexperten.com and the start-up Furniturebox, thus maintaining its leading position within the online furniture sector. Employing a similar strategy, Mat.se acquired the competitor Middagsfrid, Babyshop acquired Lekmer.se and AllOffice acquired the competitor Ocay AB.

Several acquisitions of e-commerce companies

Strategic investors seek to acquire e-commerce companies to strengthen their presence online. The Norwegian conglomerate Orkla acquired Gymgrossisten in order to strengthen their digital presence. Musti ja Mirri acquired Animail and Vetzoo, e-commerce companies specialising in pets, in order to increase online sales.

Financial investors continue to invest heavily

Private equity firms continue to be interested in consumer companies. Akademibokhandeln, Happy Socks, Revolution Race, the online travel agent Etraveli, Danska Sofakompagniet and the Norwegian Active Brands, who own Johaug, Sweet Protection and Kari Traa, have all been acquired by financial investors.

Valentum as adviser

- The Swedish e-commerce retailer RevolutionRace, that offers outdoor clothing, received a minority investment from the private equity firm Altor

- With Altor as a business partner, RevolutionRace will be able to strengthen its organisation and enables an intensified international expansion

- Valentum acted as adviser to the owners of RevolutionRace in the transaction process

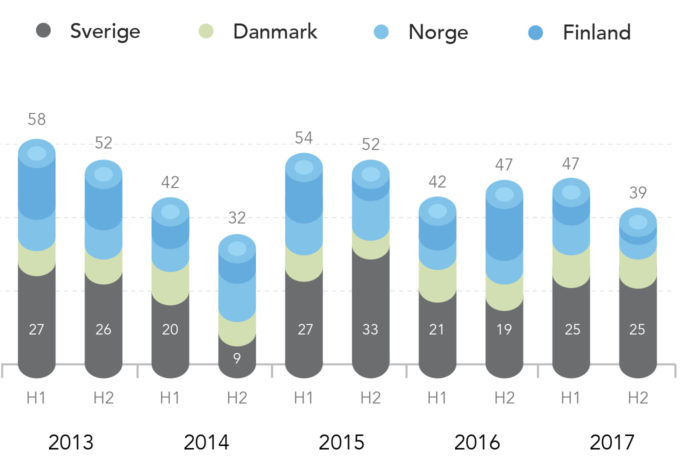

Continued high transaction volumes during 2017

The average consumer company have had a weak performance compared to the general stock market the latest years…

…but consumer companies continues to be highly valued

Nordic consumer companies listed on the stock exchange