How do private equity firms raise funds?

Private equity has made it possible to invest in unlisted companies. This has proven to be very lucrative and has made it possible for private equity firms to raise more than SEK 100 billion for their investment activities. But where is the money coming from?

When the Swedish private equity sector first was established, it was kick-started with capital from Swedish insurance companies such as Skandia and the Swedish National Pension Funds. Most Nordic banks, with SEB and Handelsbanken leading the way, also contributed by raising capital from wealthy individuals and providing additional financing.

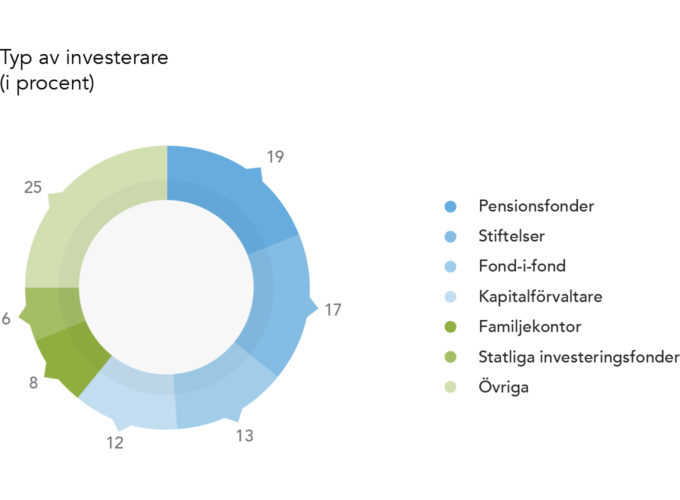

As the sector has grown, more players have become interested in investing in private equity funds. Above is a diagram illustrating the variety of investors today.

Most of the capital comes from pension funds, closely followed by trusts. To some extent, the private equity market has opened up to individuals through asset managers, but it is still difficult to invest on your own unless you are very wealthy.

Examining the pension funds, they have increased the share private equity investments in their portfolios. In 2001, alternative investments (in which private equity is included) constituted approximately 3% of their portfolios—today, it is more than 20%.

Against this background, our conclusion is that pension funds will allocate a greater share of their resources to private equity, and consequently, they will increase their involvement in the sector.

Geographical distribution

Initially, it was mainly Nordic players who invested in the Swedish private equity sector. Today, the situation has changed dramatically as a large share of funds comes from international institutions. Sweden has traditionally been an attractive market, with strong banks, entrepreneurial culture and political stability—and through private equity, there is now a new way for international investors to invest in unlisted Swedish companies. Below is a diagram illustrating the geographical distribution of the fund capital.

As shown in the diagram above, less than 20% of funds comes from Nordic investors. The largest share of funds comes from European investors based outside of the Nordic region, followed by American investors.