The importance of timing for a successful transaction

When it comes to the sale of a company, valuation is often one of the most important aspects for the seller. However, it is difficult to accurately predict what interest and valuation the company will generate. To reach the highest possible valuation, it is important to understand the parameters that affect the valuations of buyers, and to know at what point in the transaction should be carried out. It is possible to substantiate a high valuation by preparing the company for a transaction and carefully choosing the right time for it.

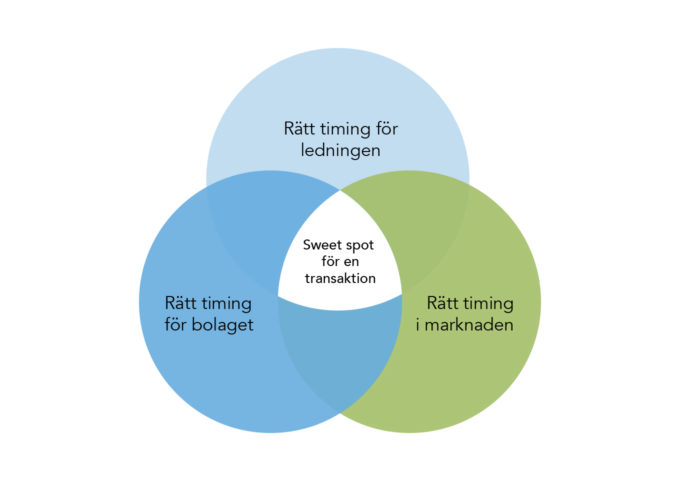

For the sake of simplicity, timing can be divided into three sections

The right time for the company

One of the first things a potential buyer examines is the financial health of the company, in particular its turnover and profit. Therefore, few owners would initiate a sales process when their company is experiencing an economic dip, or if there are other temporary circumstances that affect the turnover or profitability of the company. Frequently, the company has recently have made large investments or hired new staff, the results of which have yet to be seen, and as a result the company has not yet reached its full potential. In such situations, the buyer’s valuation is typically lower than the seller’s.

Generally, buyers often look for companies that are well established in an attractive market and show high potential for growth. Accordingly, such companies typically generate a high valuation.

The right time for the market

Company valuations are highly dependent on the general state of the market, of which macro-economic factors such as the business cycle, interest rates and stock market valuations are all important aspects. Besides the general state of the market, the state of the specific sector or industry also plays a part. If the market is facing potential upheaval, such as a shift in technology or a change in the political landscape, it will be seen as a risk which buyers will factor into their valuations.

Besides the general factors mentioned above, it is important to be examine the current state of the market for company transactions. This important step gives you an idea of when demand is high and the level of liquidity amongst potential buyers; factors which in turn affect the willingness and ability of buyers to engage in new projects.

The right time for management

Something many buyers appreciate is when the current management team is motivated to continue leading the company after a potential transaction. A valuation is in large parts based upon the buyer’s expectations for the future. If there already is a management team in place, who can present a detailed business plan, it will instil confidence in the buyer. If management is absent, a potential buyer must ensure that they can recruit a new management team, which can prove to be both time consuming and costly. New management implies a greater risk for the buyer which has to be taken into consideration in the valuation.

To maximise the valuation of the company, it is helpful to carry out the transaction when the time is right according to all three parameters. Frequently however, at least one parameter may be a bit off, something that does not necessarily entail long-lasting consequences for the valuation if the company is well prepared and necessary measures have been taken.

Valentum has substantial experience of carrying out quick processes through which companies reach the market shortly after their initial contact with us. But we are also used to longer processes in which we take an active role and guide the company through the different steps needed to prepare it for an upcoming transaction. If you have any questions regarding the timing of transactions or if you want to know more about how a transaction process is carried out, please don not hesitate to contact us.