M&A insurance allows you to avoid providing guarantees when selling your company

Do you want to avoid providing guarantees when selling your company? In that case, a so called M&A insurance might be something for you. M&A insurance is an umbrella term for an insurance solution used in connection with company transactions. Ten years ago, this solution was used very rarely, but today it is used in more than 10% of all transactions.

In a company transaction, the seller will normally provide certain guarantees for the company. This is done to insure the buyer against any potential hidden inadequacies in the company. Guarantees can for instance relate to accounting, taxation, sustainability and intellectual property rights. If the buyer finds any inadequacies within these areas, it has a right to make demands on the seller.

However, there are limitations to what demands a buyer can make on the seller. Often, the maximum sum amounts to 20-50% of the total purchase price, depending on the level of risk in the company.

When M&A insurances were first introduced on the Swedish market, they were relatively complex to incorporate into a transaction. These days, the process has improved considerably, and in many cases it can shorten the entire procedure as less guarantees need to be discussed.

In short, the solution means that instead of the seller, the insurance company becomes the buyer’s counterpart if any inadequacies are found.

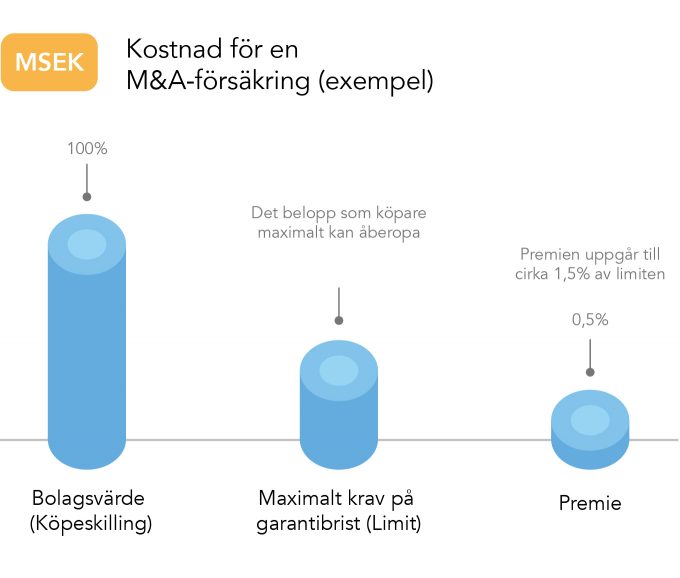

The cost of an M&A insurance varies between cases, but below is an example of a typical cost structure:

Besides the premium, there is an excess of about 1% of the value of the company. In the above example, the cost would therefore amount to SEK 1.45 million. The insurance company is responsible for any remaining amounts up to a value of SEK 30 million.

In the past, it was usually the buyer who took out the the insurance. Today it is often done by both buyer and seller, depending on the situation.

When this type of insurance was first introduced on the market, the buyer usually took out the insurance to simplify the process and strengthen their competitive position. These days, it is equally common that the seller uses it as a tool to simplify the process. In the end, the successful buyer becomes the counterpart in the insurance arrangement.

Valentum believes that M&A insurances will become more common. As they do, the cost of using them will decrease, which will further increase their attractiveness. However, it is not always preferable to use an insurance. Every transaction is unique, consequently it is very important to weigh up the pros and cons. The decision hinges upon the risk appetite of the seller.

If you want to know more about how M&A insurances work, or find out if it might be suitable for your company, do not hesitate to contact Valentum. We will advise you.