Strategic premiums and synergies – what is it and how do you get paid for it?

There is a general understanding that a strategic, or industrial, buyer can pay a premium for a company compared to a financial investor. This is only partly true. The difficulty lies in converting synergies and other strategic aspects into money, and comparing the result with what a financial buyer would be willing to pay for the company. In the end, a strategic buyer has to be able to pay for these synergies.

Most larger companies in Sweden have some kind of acquisition strategy in place, perhaps even their own M&A department assessing interesting acquisition opportunities on a daily basis. The most common rationale behind carrying out acquisitions is promoting growth and strengthening the market position. Alternative motives could involve gaining access to a particular product and/or technology, or wanting to take a step forward or back in the value chain. Irrespective of the rationale, there is a possibility that a strategic buyer pays a strategic premium.

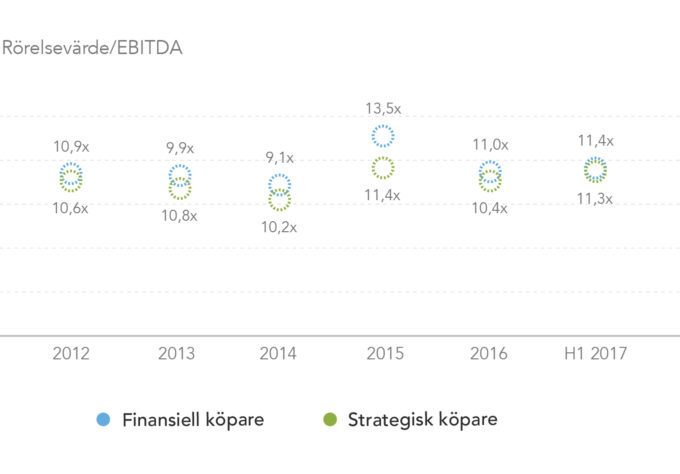

However, there is no clear evidence to suggest that strategic buyers always pay a premium. In the period between 2012-2017, the average valuation level amongst strategic buyers in the Nordic countries was only higher than that of financial buyers in the years 2013 and 2014.

Comparing the valuation levels of strategic versus financial buyers

So what factors can help create additional value for a strategic buyer? First of all, continuing to protect and develop the on-going business before, during and after the transaction process. In many cases, a transaction process affects the on-going business negatively, often manifested as a loss of revenue in the first quarter, something which both financial and strategic buyers can be apprehensive about. To create a sense of security, it is essential that a seller can maintain “business-as-usual”, even during the transaction process. This means that a seller must make sure to protect customer relations, not let the integration process become too time consuming and ensure that key personnel remain in the company after the transaction has been completed. A sense of security regarding such aspects is an essential factor in creating value.

A second step—possibly the most important for creating value—is to make sure that a strategic buyer finds strategic and operational synergies, and then ensures that the value of the synergies is included in the purchase price.

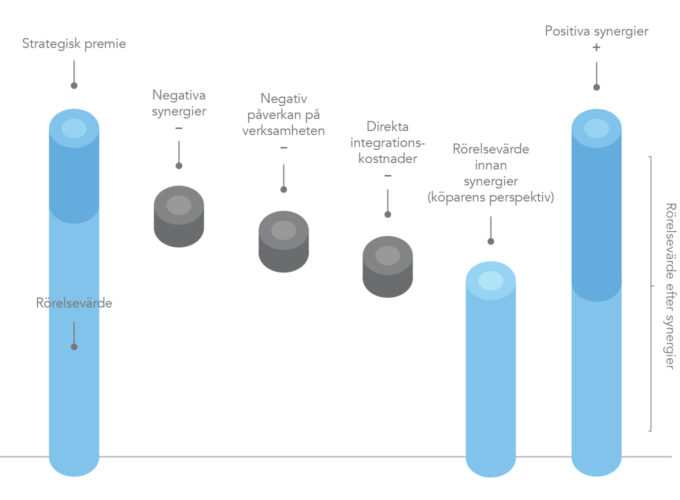

Positive synergies must exceed negative synergies and integration costs in order for a strategic premium to arise.

| Negative synergies When a strategic buyer acquires a company, negative synergies may arise that will decrease the value of what the buyer is willing to pay. It could be due to pay rises and bonuses needed to ensure equal compensation for all employees, or because the owner wants to reduce his or her operational responsibilities which in turn may have an impact on sales and customer relations. |

||

| Negative impact on the business The transaction process often requires a lot of attention from both management teams which can lead to a negative impact on day-to-day business operations. |

||

| Direct cost of integration All strategic acquisitions require some sort of integration process which often implies additional costs. It could be due to the need of implementing a corporate business system, moving, rebuilding the premises or strengthening the finance department. |

||

| Positive synergies Positive synergies are often divided into three categories: synergies of cost, synergies of income and financial synergies. In theory and for larger companies, focus is often on synergies of cost, for example due to economies of scale, a centralised head office or supplier cost reduction. Small and medium-sized companies may, however, struggle to incorporate such synergies into the purchase price. In such cases, focus tends to lie on synergies of income such as cross-selling or pushing more products and services through the distribution channels. Quantifiable financial synergies are less common in small and medium-sized transactions but centralised warehousing or lower interest costs are possible sources. An important aspect that has to be considered is how to realise synergies in practice; ‘We own this company now, how do we create value?’. There has to be a credible plan in place to realise identified synergies. |

||

| Strategic premium A supplementary premium added to the enterprise value a strategic buyer is willing to pay. The size of a potential premium depends on the size of the synergies which the buyer is able to identify in the company. The buyer must find itself required to pay a premium in order for it to be realised. Even if a strategic buyer has identified synergies and has a plan to realise these, the buyer is not going to pay a higher price voluntarily. A bidding process is needed for the buyer to pay a higher price. |

An important part of the selling process is creating a competitive bidding process in which as many buyers as possible, financial and strategic, can bid on the company. This way, the seller is given a clear picture of the buyer universe and improves its opportunities of finding the right buyer. It also improves the chances of realising the maximum value of the company.

Depending on the preferences of the seller, Valentum always contacts both financial and strategic buyers and has experience in leading the process forward with several types of buyers. If you have any questions or need more information, do not hesitate to contact us.