The right preparation ahead of a sale ensures a high valuation

To complete a successful transaction, there are various parameters an owner should consider before initiating a process. Through careful preparation, ensuring the best possible financial structure, as well as advising and motivating senior executives, it is possible to determine the optimal time for a transaction.

Preparations ahead of a coming change of ownership

The owners’ ambition

First of all, a detailed plan of the change of ownership is essential. The plan should address the following:

- Understanding of the current position and future potential of the company

- A review of the owners’ priorities and targets. Only ofter such a review can a decision regarding exit options, the process and the time frame be made

- A description of the business model at the time of the sale

- A review of tax implications at the time of the sale

- Identifying risks that could affect the timing of the sale

Value drivers

To ensure that potential investors place their bids in the higher end of the valuation range, it is recommended that the owners create an agenda of action points. These are usually called value drivers. Naturally, there are specific value drivers for different companies but many of them are universal:

- Demonstrating growth – adds credibility to the forecast

- Avoiding dependency on customers and suppliers – reduces the operational risk

- Demonstrating control over costs – optimising costs that are not vital to the business

- Promoting new initiatives – shows investors that there is future potential

- Understanding of how the market is evolving and which are its main value drivers

- A review of the company’s potential for growth through geographical expansion, new products or acquisitions

Valuation

The valuation aims to provide the owners with a realistic target value before the transaction process is initiated. A valuation should be based upon: the company’s financial performance and cash flow; the number of potential investors and their acquisition history; the company’s uniqueness; a valuation of the synergies a potential investors could unlock through an acquisition; a comparison with comparable listed companies and comparable recent transactions.

Step 1 – financial structure

To maximise the value of a company, it is important to go through its financial structure, and the first step is a thorough financial follow-up. During a transaction process, potential investors will examine the company’s financial history, especially its income statements and balance sheets in the last two to three years. Having these readily available and in good shape can provide reassurance and create confidence regarding the company’s future.

To maximise the value of a company, it is also important to examine how the assets are tied up in the business. This is done through an analysis of the working capital—inventory, receivables and payables. Cash not used for purchases or supplier payments remains as a liquid asset. There is a lot to gain from optimising the working capital.

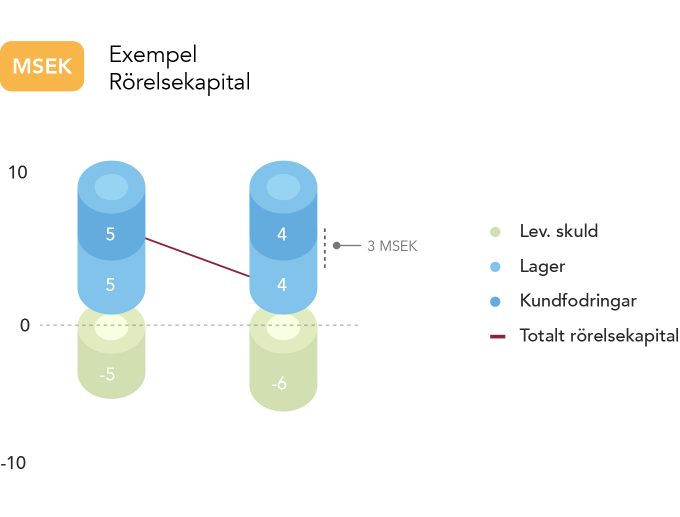

Example – working capital

Stock and receivables result in higher working capital whilst payables lower working capital. Lower working capital means less tied up resources, and more liquid assets for the company. The graph above illustrates how a reduction in working capital leads to an increase in liquid assets of SEK 3 million.

A buyer will analyse the extent to which resources are tied up in working capital. The lower the figure, the higher the value of the company. In the above example, the owners receive SEK 3 million more after having optimised the working capital.

Step 2 – Senior executives

A common problem when selling a company is the dependency on the owners. Being able to show that the business is not dependent on the owners’ operational efforts creates security and minimises the risk for the buyer. During the preparation process it is important to do the following:

- Identify possible future executives

- Establish competent middle management who can share the responsibilities of daily operations

- Establish a capable finance department, separate from the owners, that is capable of examining the financial performance of the company and producing the necessary financial reports

- Transfer important customer and supplier relationships to people in the company other than the owners

These changes take place over a longer period of time and it is important that all steps are taken without risking any damage to the business.

Another important factor is creating a robust follow-up process for the business which shows the progress towards its targets. If the target is clear, it will help fostering a stronger corporate culture, lead to a greater sense of security amongst employees and, in turn, increase the chances of reaching the owners’ targets.

In order to create a strong corporate culture and a shared ambition to reach the target, it could be a strategic decision to provide employees with additional incentives. For example, bonuses can be distributed amongst employees once the business has completed the established action points.

Step 3 – Finding the right time for selling

A transaction process takes approximately six months from beginning to end. Outside of this period, it is common for the new owner to demand that the previous owners remain in the company, both operationally and financially, for a predetermined length of time. If the seller occupies a leading position in the company, it is not unusual that the new owner demands that the seller remains in the company for six months to up to three years. The seller is usually provided with strong financial incentives to remain in the company throughout such a period. This aspect is important for a seller to understand when deciding when to initiate the process.

Generally, industrial investors make fewer demands of sellers, and they often acquire 100% of the company. If the sellers do not wish to stay with the company, they are usually required to transfer their leadership and responsibilities to a new management team.

Financial investors seldom acquire 100% of the company as they are dependent on the seller’s industry expertise. In addition, the company’s forecasts are often deemed more credible if the seller retains a stake in the company.

If an owner wants to keep developing the company, but at the same time realise a large share of the value already created, it can be an attractive alternative to sell a share of the company to a financial investor. Aside from contributing with fresh capital, the new partner can support the company in its future expansion.

Summary

Valentum has extensive experience of helping successful entrepreneurs prepare a company for sale. To achieve the best possible outcome, the preparatory work should be commenced in good time before the transaction process begins.

The preparatory work should include:

- A general plan of the owners’ targets and time frame

- A detailed plan of value drivers with corresponding action points

- A valuation of the company in line with the owners’ value expectations

- A review of the financial structure to ensure an optimisation of the cost structure

- A initiated plan for how the dependence on current owners can be reduced in the future