The M&A market for software remains stable with high transaction values in 2017

Continued stable M&A market in the Nordic countries with increased interest from private equity and high average transaction values.

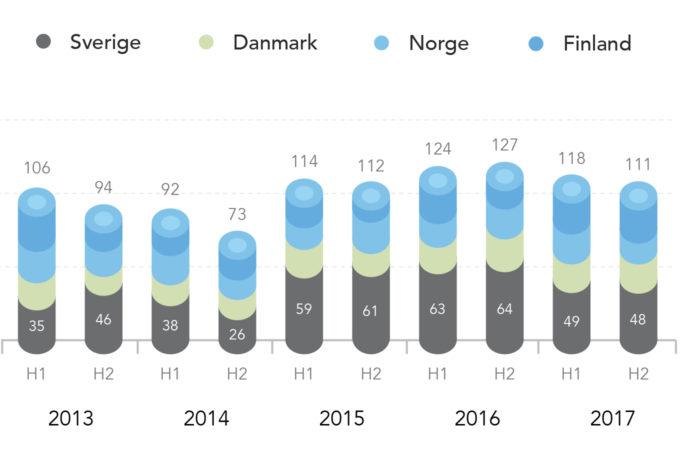

The transaction pace slowed down slightly in 2017 compared to 2016. In total, 229 transactions were completed compared to 251 transactions the previous year. However, the average transaction value increased by 9% and the total transaction value* exceeded SEK 110 billion.

Acquired companies during 2016

Strategic investors dominate but private equity firms are investing increasingly

As in previous years, it is strategic investors that perform the majority of the acquisitions. At the same time, financial investors have shown an increasing interest in the sector and were, during 2017, responsible for 30% of the acquisitions.

Private equity is investing large sums in the software industry

The largest transaction in 2017, in terms of enterprise value, was carried out by a consortium of financial investors, consisting of Advent International and Bain capital amongst others. Collectively, they invested SEK 51.7 billion in the Danish payment processing company Nets. HgCapital conducted the second largest investment of SEK 46.3 billion when they bought out the other financial owners of the ERP-system developer Visma.

Internet and application software most popular

Most investments in 2017 were performed in providers of internet software and services, totalling 72 transactions. Amongst these, White Mill AG invested SEK 32 million in the Swedish BIMobject, at a valuation of SEK 900 million. An investment that makes it possible to strengthen the company’s technology portfolios with products such as intelligent cloud solutions and internet based infrastructure. Application software was the second most attractive sector with 65 transactions. Nokia acquired Comptel in the highest valued transaction at SEK 3.3 billion, in order to strengthen their software strategy. Consultancy companies along with other software and data processing companies attracted 54, 24 and 17 acquisitions respectively.

*Total transaction value refers to the sum of all transactions where the purchase price has been disclosed.

Maintained high transaction levels in 2017

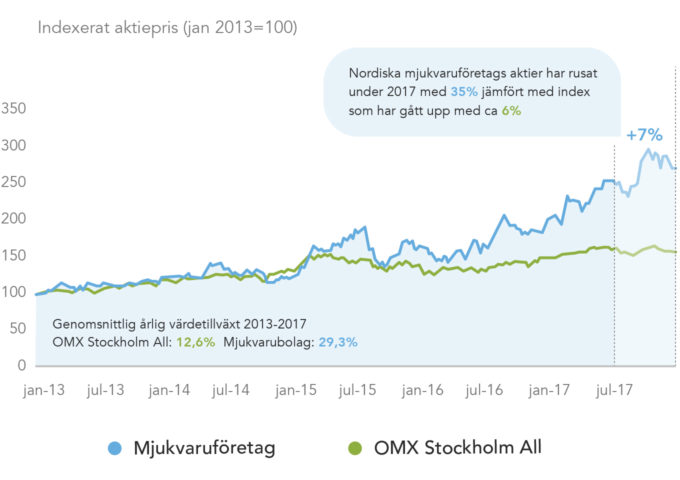

Continued positive development for Nordic software companies on the stock market

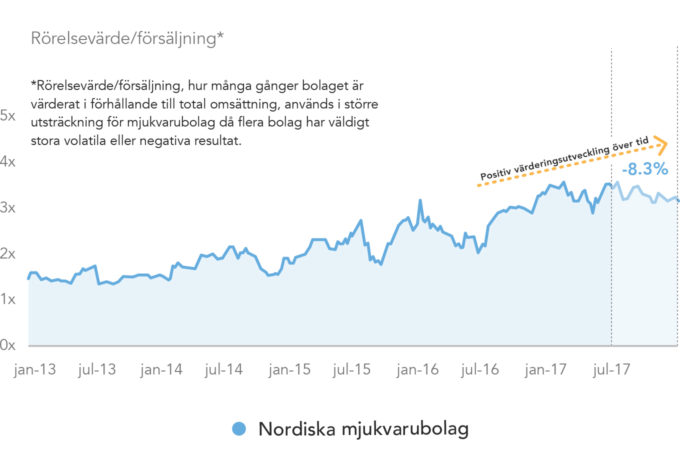

The most recent years’ positive value development has slightly stagnated during H2

Nordic software companies listed on the stock exchange