Here’s why the bid on your company is not as good as you think

And what makes Valentum so sure of that? The answer is easy: the first offer is very rarely the best. Just consider yourself for a while. If you were thinking of buying a second property, would you reveal your highest bid right from the start? Probably not. Of course, there is a difference between a company and a property, but the reality is that company valuation often is a guessing game.

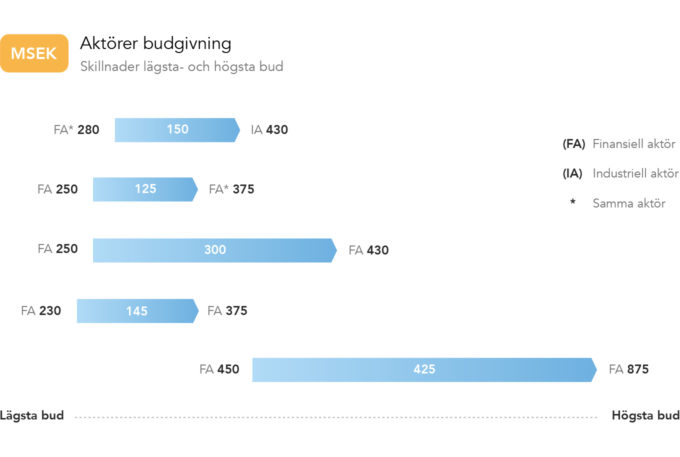

Receiving an offer on a business which you have built is flattering, but following your first impulse and accepting the bid can have dire consequences. In Valentum’s experience, the difference between the lowest and the highest bid can in excess of 100%. And you can rest assured that the first bid you receive never is the highest.

So how come investors come up with such vastly different valuations despite having access to the same information? The answer is that these days, companies are highly dependent on ideas and people. 50 years ago the value of a company typically lay in its machinery or its factories, physical assets that were easy to value. Today, the valuation is almost exclusively based on beliefs regarding the future of a company.

And the future is subjective. How many products will the customer want to buy in five years’ time? How will my product compare to my competitors’ in five years’ time? What will the general economic situation be like in five years’ time? There is no right answer, which is why there is no such thing as a correct valuation.

There are also many pitfalls to beware of when entering a process without good advisors. Many buyers demand that you sign an NDA and that you do not discuss the deal with anyone else. This is a tell-tale sign that their bids are too low. You should always reserve the right to ask an advisor if a bid is reasonable.

Buyers often present you with imaginative ways of conducting the deal; complicated arrangements using preference shares or different additional considerations. Our experience tells us that such arrangements are used to make bids seem better than they actually are.

Another risk of accepting a bid can appear well into the process. If the transaction is worth more than SEK 100 million, the buyer will initiate an extensive investigation of your company, in which the buyer will scrutinise every single part of it. If the buyer wants to lower the bid after the due diligence, you are in a bad negotiating position; you will have spent a great deal of time and effort on one buyer without having any others lined up.

If you have received a bid on your company, or if you are thinking of selling, you have everything to gain by contacting us!