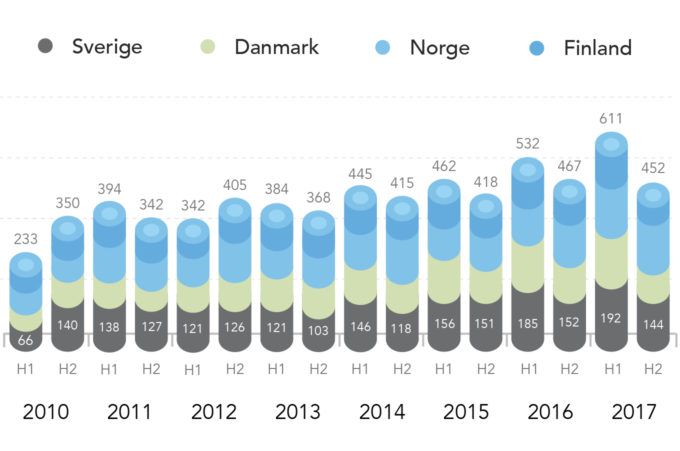

Transaction levels at an all-time high in the Nordic countries during 2017

After a record breaking opening in H1 2017, the Nordic M&A market has slowed down slightly. At the same time, valuations are higher and transactions are larger than ever before.

Selection of buyers and private equity firms that have invested heavily in the Nordics during 2017

2017 started strong with a new record number of transactions, but during the second half of the year, the levels of transactions have gone down slightly. However, looking at value and valuation multiples, the market is considerably stronger than the previous year.

High enterprise values and valuation multiples

In 2017, Nordic companies were valued at 11.5x EBITDA on average, which is significantly higher than the average in 2016 at 10.1x EBITDA. The average enterprise value also increased with more than 12% which suggests continuously increasing valuation levels.

Private equity firms invest heavily in Sweden

Several large transactions were carried out in the Swedish market by private equity firms. In 7 of the 10 transactions with the largest enterprise values during the year, private equity firms were the buying party.

Swedish companies acquire Swedish

67% of the transactions in the Swedish market in 2017 were conducted by Swedish buyers. The transaction with the largest enterprise value was Kinnevik’s investment in ComHem, which was valued at SEK 31 billion, amounting to 5x the turnover and 11.5x EBITDA.

Trends in the market

Great availability of capital in a liquid market

- Many large strategic investors have accumulated capital since 2008, implying a good availability of capital

- The number of companies financed by private equity increases and these companies are more active in the M&A market

- Interest rates on historically low levels result in cheaper acquisition financing and allow for higher leverage

- The interest rates are expected to increase slightly during 2017, substantiated by the LIBOR interest (3 months) increase in 2017 from 1.04% to 1.54%.

Software and tech are no longer just for tech companies

- Strategic players acquire in order to increase innovation pace, efficiency and to develop products, services and sales channels through e-commerce.

- Acquisitions are a shortcut to in-house technical development. Development of in-house technology requires expertise, is costly and is time consuming.

Record breaking M&A activity during 2017 despite a slight slowdown during H2

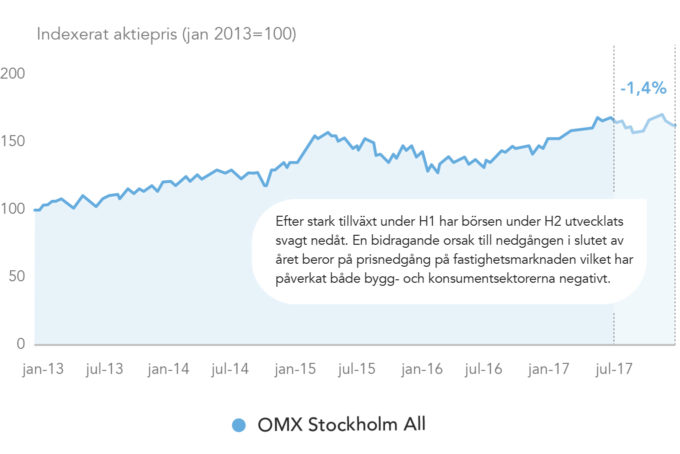

Slight downturn on the stock market during H2